BIM Hype: is BIM all it’s cracked up to be?

We’ve been served up a steady diet of BIm hype for some years now, and BIM has a lot to show – at least in terms of bling, for all the chatter, as the recent 2014 AIA Technology in Architectural Practice (TAP) BIM Awards do in stunning fashion. A great link (better than AIA’s) can be found at Building Design + Construction’s website , where slide-shows of each award winning project can be viewed or downloaded.

There were a smattering of BIM applications exhibited at TAP, and all the various attributes of BIM are featured:

- Maximum communication and visualization of design intent to owner (Shanghai Disney)

- Complex layered rendering and modeling that was used for constructability analysis, and the shop-drawing, fabrication, and construction processes (Perot, ARTIC, Outpatient Care Pavilion)

- Laser scan and plotting of existing space to facilitate retrofit (Van Buren Office Building)

- Cost-savings and expedited schedule (Van Buren Office Building, Pegula)

- Facility Management (Rehabilitation Hospital)

Looking at the more opulent AIA winners, it seems that the most impressive works are those that involve complex geometry, such as compound curves, e.g., ARTIC, and the Morphosis designed Perot Museum. The Perot Museum is notable in that it substantially incorporated BIM into the shop-drawing, fabrication, and construction processes; as a builder, what I perceive to be a maximum benefit of a BIM program.

On the other hand, it was noted that “steel erection finished one-week ahead of schedule,” indeed, a negligible achievement on a project of this complexity. The best ROI for BIM on any project is when it realizes most or all of the benefits BIM has to offer. For example, a costly BIM program that only is used to generate bling for PR purposes is a futile intellectual exercise.

Early 3-D modeling, such as that used on Gehry’s Bilbao Museum, inspired the advent of 3-D digital modeling into architecture, which evolved into BIM. The technology was originally intended to facilitate BLOB architecture -that was considered stylish at the time- which it did with robotic laser scanning; a technique gleaned from the aviation industry. The more generic and boxy Pegula Ice Arena probably could have been built just as easily without BIM.

However, for projects with complex infrastructure, such as the Outpatient Care Pavilion’s mechanical floor, BIM helped facilitate clash detection, or when various elements or program are subject to spatial conflict. Of course, clash detection could still have been conducted manually, or in the traditional fashion. The point being that BIM makes more sense for complex projects. For your garden variety or average projects, implementation of BIM would constitute overkill.

The over the top $5.5B Enchanted Storybook Castle, Shanghai Disneyland Park, at number 5, was also touted by the AIA. But integration of BIM for this project seems more of an intellectual exercise, than a practical application, i.e., a lot of tedious fancy layered modeling to wow the owners and clock up billable hours. Between the building team of Walt Disney Imagineering and Gehry Technologies, I daresay there were no holds barred. The TAP jury stated

“(they) are doing what all architects should be doing. They are saving having to reconstruct. They use many different tools that should be used on every project. The storybook castle are (sic) tools that should be leveraged in all practices.” Not exactly an examined point of view. I have my doubts that the excess of the Story Book Castle would be invoked “in all practices.

After all, most of the castle will not be built, but fabricated. Even so, to say there will be no reconstruct work on a project of that level of detail is mighty ambitious.

BIM is indeed an impressive technology that no doubt holds brilliant promise for the future of some component of the AEC community. But trying to find out just how fast it is catching on in the building industry is an elusive undertaking. Data on BIM statistics is sparse, and inexplicably resistant to analysis. I also believe that the implementation of BIM in the industry in general is still negligible (see below), or exists chiefly in the esoteric vacuum of a short-list of big-fish players, many of whom I suspect make the investment for one-off projects, rather an expenditure likely built into the contract price under the tenet that the program will pay for itself. While I do believe the biggest users are realizing the long-term benefits of

- Reducing rework

- Optimizing program pre-coordination

- Reducing project duration

- Reducing document errors and omissions

- Reducing claims and litigations

Many of them don’t really know how much since “44% of BIM users do not formally measure their BIM ROI.”[i] It also must be said that there are distinct levels of level of development (LOD)[ii] levels 100-500 among users – from basic laser scanning to full 4D model implementation, which vary in the industry, and are the final determinant of ROI.

The bulk of the available data regarding BIM adaptation seems to (overwhelmingly) come from two dizzying McGraw Hill studies;[iii] data which is endlessly republished across the Internet by other ‘researchers.’ Such duplication is not research of BIM, per se, but repetition of (the same) BIM study. The sparseness of available data sources is disconcerting. The McGraw Hill study is curious in that it is often inconclusive and contradictory: no concrete picture seems to emerge, and there is no discussion to resolve troubling, conflated data. At times, the study suggests BIM adaptation is in some ways viral, and under-utilized and lagging at the same time. On the whole, there is a strong sense of the tail wagging the dog. Indeed, the leading article in McGraw Hill’s 2013 Global Survey addresses ROI, and perhaps half of the study focus is on ROI.[iv]

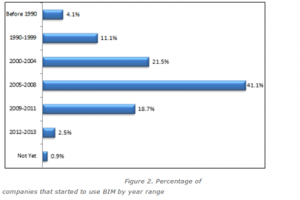

For 2013 McGraw Hill touted 74% adoption by contractors, and 70%, by architects and engineers – a reversal of the former year’s survey, where design-side use was higher. This makes it sounds like contractors are even leading the charge except “(they) have only half the engagement level of architects.” That doesn’t make sense, because I should think any BIM project starts with the design-team. McGraw Hill’s study states “industry wide adaptation of BIM surged from 28% in 2009 to 66% in 2012.” Whereas, the bar chart, below, shows BIM starts peaked post-2008, and dropped off considerably ever since.

The observation that “size matters in BIM adoption is telling. About 90% of large and medium to large organizations are engaged with BIM” (MH 4). I find that point to be lacking context. It would seem that the impetus to use BIM starts with the owner or design team, and the contractor is induced to join the process. If a project is not designed with BIM, the contractor cannot build it with BIM.

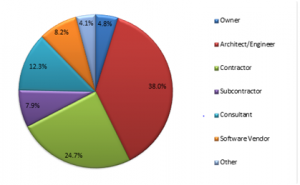

What are we to make of this data? Another survey[v] published in Bimjournal, using 745 global profiles, shows about 25% of general contractors using the software, and about 8% of sub-contractors, who are more likely to outsource the work, as they don’t have the program. This same study measured adaptation as between neutral and somewhat mature. The Bimjournal data is in contrast to the McGraw Hill data in that it calculates higher usage among architects than among contractors, and lower usage, in general (see pie chart).

However, McGraw Hill data was taken from a pool of some 727 international respondents; 291 of which were US firms. According to the survey, “(it) targeted contractors that use BIM,” most of which were the worlds’ largest stakeholders. The study was led by AutoCad – the biggest BIM software provider, and advertiser with McGraw Hill. That said, the picture of just how far and deep BIM is really influencing the industry seems rather murky.

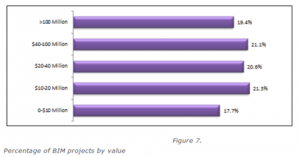

According to another 2012 study[i], some $36B (most) of BIM driven 2011 construction revenue was distributed among the top 25 contractors surveyed, the largest, Turner, at $5.4B. Total US construction spending for 2011 was $816B. By that rule, BIM comprised some 4.5% of all US construction spending. Statistics for 2012 were similar[ii], although I note certain big players present on the list one year, and gone the next, signifying one-off mega-contracts. The following graph illustrates the distribution of BIM use according to project contract value:

According to Building Design + Construction’s 2013 Giants 300 Survey, 80% of the nation’s largest architecture, engineering, and construction firms have adopted BIM/VDC tools and report having earned revenue working on BIM-driven projects.” I daresay that the tendency must also be to over-report such spending. However, as David Barista, Editor-in-Chief at Building Design + Construction says, the value of BIM driven projects in the survey is difficult to qualify.

For example, a project may be driven only in partial aspects of a given project. Various team members may also use the models more or less than others. Thus self-reporting BIM driven value in a survey is a slippery slope. Mr. Barista and Building Design + Construction plan to reify the data for their 2014 in such a way that a greater exactitude in reporting can be realized.

As regards contractor participation, the McGraw Hill study also states “with a very negative value/difficulty ratio (-26%) and a below average frequency index (2.3), the use of 4D BIM models by contractors is clearly still in its developing stages. Even very high E-level contractors report low use, and all firms report high difficulty. Despite the high profile 4D work being done by some of the larger contractors, most firms cannot take advantage of this activity” (MH 49). Thus, although the perception is that BIM use is becoming more mainstreamed, contractors are struggling mightily with it.

Although BIM use is on the increase, “30% of non-users say they will never use BIM: this group has more than doubled in size since 2009, and is most extreme with 2012 architects, 38% of who are devout non-users” (MH 37). Most – almost 2/3 of all BIM driven projects were budgeted over $20M, mostly by the largest entities. The measurable relevance of BIM may be arguable: “adoption between 2007 and 2009 expanded by 75%,” and “the ranks of heavy users will triple from 21% in 2009, to 55% in 2014” (MH 13).

Despite that, a comment in the McGraw Hill study from one of the design industries biggest users says

“I think there’s going to be a huge shake-out. Those who practice the old way are soon going to find themselves without work. Either change, get with this program, or go out of business.”[i] But then he also states more reasonably in response to the question ‘how has BIM impacted the construction industry?’ that “[it has] cleared away a lot of the bureaucracy of getting a building built with processes that are saving real time and money. For instance, instead of going all the way through working drawings, engineers are giving contractors a BIM model much earlier, which they can use for fabrication. We are seeing fewer RFIs, which means more efficiency, more sureness, more speed of construction.

Indeed, I put the question to Mr. Barista, who believes that BIM will inevitably become mainstreamed in the next twenty or so years, however, but for now, it’s anyone’s guess as to the actual market value of BIM driven projects.

The McGraw Hill study says “construction related activities are more recent applications of BIM. Therefore, in general they are less mature. Constructability analysis and job site planning/logistics are contractors’ top uses. All users report struggling with 4D and 5D,” and “contractors have slightly higher adoption of BIM, but only half the engagement level of architects” (MH 6), which begs the question ‘why is use higher among contractors than architects’ (74 vs. 70%) especially if only 8% of their trades and fabricators use it? This notion makes me wonder ‘is anyone actually building anything with BIM, or just looking at fancy models?’

BIM first becomes relevant to the building process during preconstruction – in the constructability review and clash detection stages, which are followed by the modeling process, where CAD drawings may be issued to CNC fabricators for production. Some fabrications can be made directly from the BIM models, whereas many use the models as background for their shop drawings, which is often the case when there is no lingua franca between the BIM and CNC programs (in programming parlance, they don’t ‘talk to’ each other). Given the lack of standardization, BIM file format fragmentation and the ensuing lack of interoperability between programs is a bane of the industry. Even among BIM programs there is a lack of standards.

My gut tells me that for builders, BIM is most useful for constructability and logistics analysis, and general clash detection. Depending on the product, proper shop drawings must be developed by a fabricator to ensure coordination and proper dimensioning. Structural steel, and mechanical, electrical, and plumbing systems (78% and 60% respectively) are the most typical model driven fabrication trades.

This works for modular construction, and projects with lots of room to fit all of the program, but it becomes more problematic as spatial tolerances decrease, and once the deign steps out of the modular concept. It makes sense that modular steel and MEP can be fabricated right from the BIM model, as there is little or no other program these first-in trades need to worry about conflicting with: subsequent and more detailed program is expected to fit around the steel and MEP, and does not benefit from modeling in the same way

For example, masonry, carpentry, and architectural millwork and metal work. By and large, ‘fit-out’ trades must visit the site and take field measurements from existing elements and adjoining program, rather than attempt to fabricate from a model. Again, once the trend is away from modular to custom, the ROI of BIM models for fabrication decreases.

Not to say BIM has peaked. I hope it has not, as I have said it shows brilliant promise. However the following graph suggests that new BIM implementation is tapering off; or rather those who are most expected to utilize it have already bought in:

The 2008 drop-off must in some measure be a result of the recession; however, subsequently, there is a discernible pattern of less adaptation taking place. If the graph more or less represents most of BIM adaptation, it can be argued that BIM is as mainstreamed as it ever is going to be. Even if the value of all BIM driven work doubled, it would still represent less than 10% of all US building.

Major obstacles remain, such as the prohibitive cost of the software, and the training and staff to implement it. Also, technical issues abound, such as lack of interoperability with various file formats. Before BIM can really take off, a standard will need to be adopted, such as the Building SMART Alliances approach to National Building Information Modeling Standard-United States (NBIMS-US), which encourages an industry-wide approach. According to Dana K. Smith, FAIA, “While we appreciate the amazing support we have received; our initial assessment is that it is going to take a very long time to affect industry change at the rate we are currently moving.”[ii]

Frankly, it follows that there is a cut-off of when implementation of BIM is beneficial. Smaller projects and the AEC community simply aren’t major stakeholders in the evolution of BIM, and don’t appear to be anytime soon. According to McGraw Hill, the US, UK, and S. Korea, lag well behind BIM leaders Japan, Germany, France, and Canada in terms of ROI. Despite that, the earliest adaptation was in the US. The US has 28% adaptation for use over 6 years, more than any other region. It would be interesting to understand why such is the case. Do these countries benefit more from BIM, or are lagging countries technological and design backwaters compared to their betters? Judging from the number of complex curvilinear structures completed inside the US as compared to elsewhere this would certainly seem to be the case here in the States.

At the end of the day, I fear no one really knows how mainstreamed BIM is now, or will be in twenty-years. But in order to make the assessment, it is necessary to scrub all the smoke from the room, and look at hard facts. Who uses it, and to what extent, facts which in my mind have not been adequately determined, or published; given the quality and integrity of available data on the subject. I was left to do my own research. For example, try to search the Internet for “total-US-BIM-construction, or “total-value-US-BIM-projects,” and see the results: not awe inspiring. Even if BIM does become more mainstreamed, most building can and will happily carry on with or without it. No one is going out of business if they miss the train. Although it can serve a great purpose to the design industry, I don’t see the wholesale mainstreaming of BIM into building anytime soon.

[i]The Business Value of BIM in North America SmartMarket Report, McGraw Hill, November 2012

[ii]

[iii]2012 Research Shows Dramatic Increase in Use of BIM in North America, Modlar, October, 2012

[iv]Business Value of BIM in Global Markets, McGraw Hill, 2013

[v]Building Information Modeling Maturity in North America, BIM Journal, March 3, 2014.This survey polled 2,050 practitioners, of which 316 were BIM users. Only data from the 316 was kept.

[vi]BIM finally starting to pay off for AEC firms, Building Design + Construction, July 2012

[vii] BIM 2.0: AEC firms share their vision for the great leap forward in BIM/VDC implementation [2013 Giants 300 Report], Building Design + Construction, July 2013

[viii] Bimjournal 4

[ix] MH 15, Patrick MacLeamy, CEO, HOK

[x] Bimjournal 2

[xi] Journal of Building Information Modeling, Spring 2012